The Only Guide for Mileagewise - Reconstructing Mileage Logs

The Only Guide for Mileagewise - Reconstructing Mileage Logs

Blog Article

The 4-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Table of Contents10 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.8 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownUnknown Facts About Mileagewise - Reconstructing Mileage LogsSome Known Questions About Mileagewise - Reconstructing Mileage Logs.Mileagewise - Reconstructing Mileage Logs for BeginnersThe Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Distance function recommends the quickest driving route to your staff members' location. This feature improves productivity and contributes to cost financial savings, making it an essential possession for organizations with a mobile workforce.Such a technique to reporting and conformity streamlines the usually complex task of managing gas mileage costs. There are lots of benefits related to making use of Timeero to track mileage. Let's have a look at several of the application's most notable functions. With a trusted mileage tracking tool, like Timeero there is no need to bother with mistakenly omitting a day or item of details on timesheets when tax obligation time comes.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

With these tools in operation, there will be no under-the-radar detours to raise your compensation costs. Timestamps can be discovered on each mileage entrance, boosting reputation. These extra confirmation steps will keep the internal revenue service from having a reason to object your gas mileage records. With precise gas mileage monitoring innovation, your staff members do not have to make harsh mileage estimates and even fret about gas mileage expenditure tracking.

For instance, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all car expenses. You will need to continue tracking gas mileage for job also if you're utilizing the real expenditure method. Keeping mileage records is the only way to separate service and individual miles and supply the evidence to the internal revenue service

The majority of mileage trackers let you log your trips by hand while determining the distance and compensation amounts for you. Numerous likewise come with real-time trip monitoring - you require to start the application at the beginning of your trip and quit it when you reach your final destination. These apps log your beginning and end addresses, and time stamps, along with the total range and repayment quantity.

5 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

%20(1).webp)

Among the concerns that The INTERNAL REVENUE SERVICE states that automobile expenses can be taken into consideration as an "average and needed" cost in the training course of working. This consists of prices such as fuel, maintenance, insurance policy, and the automobile's devaluation. For these costs to be taken into consideration deductible, the lorry ought to be utilized for business functions.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

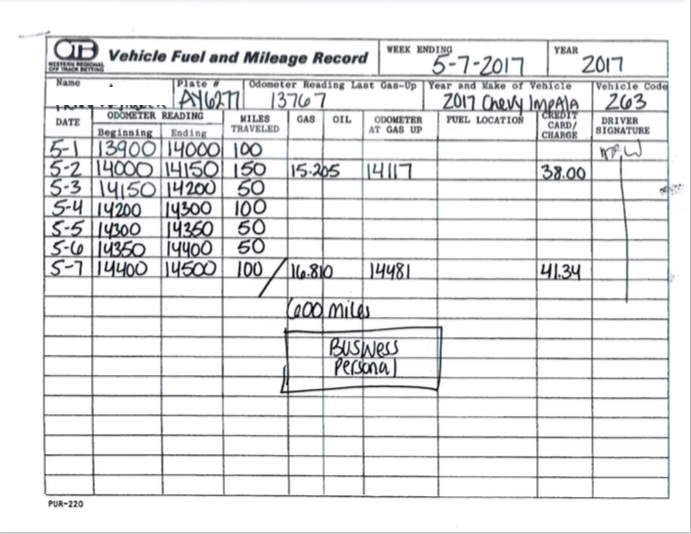

In in between, faithfully track all your service journeys noting down the beginning and ending readings. For each trip, record the area and company objective.

This includes the complete company mileage and overall gas mileage buildup for the year (organization + personal), trip's day, destination, and function. It's important to tape-record tasks immediately and keep a coeval driving log outlining date, miles driven, and service objective. Here's exactly how you can improve record-keeping for audit purposes: Beginning with guaranteeing a thorough mileage log for all business-related travel.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

The real expenditures technique is a different to the common gas mileage rate technique. As opposed to calculating your deduction based upon a fixed rate per mile, the real costs approach permits you to deduct the actual expenses linked with using your vehicle for organization functions - simple mileage log. These expenses consist of gas, maintenance, fixings, insurance coverage, devaluation, and other associated costs

Those with substantial vehicle-related expenses or one-of-a-kind conditions may profit from the real expenditures approach. Eventually, your selected method needs to line up with your particular monetary goals and tax circumstance.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

(https://myanimelist.net/profile/mi1eagewise)Determine your total company miles by using your start and end odometer readings, and your taped company miles. Precisely tracking your specific gas mileage for service journeys aids in confirming your tax obligation deduction, especially if you choose for the Standard Gas mileage method.

Keeping track of your gas mileage by hand can need persistance, but remember, it could save you cash on your taxes. Tape-record the overall gas mileage driven.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

And currently virtually every person utilizes General practitioners to obtain about. That suggests nearly everybody can be tracked as they go regarding their business.

Report this page